Behavioral Economics Dissertation Help

Your Partner for Academic Excellence in Behavioral Economics Research

Your Partner for Academic Excellence in Behavioral Economics Research

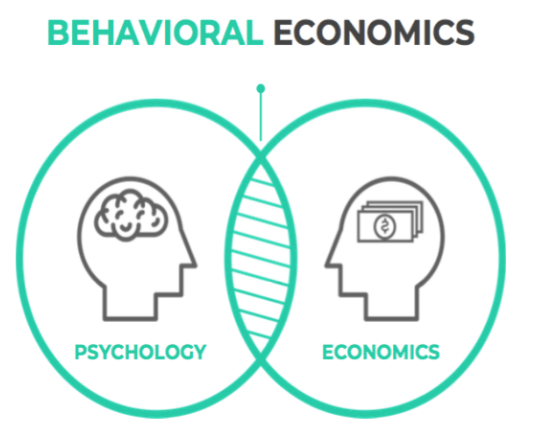

In today’s rapidly evolving economic landscape, understanding how human behavior influences financial decisions is more critical than ever. Behavioral economics, an interdisciplinary field merging economics and psychology, provides valuable insights into why individuals sometimes deviate from traditional economic models. Whether your focus is on consumer behavior, decision-making biases, or the impact of social norms on market outcomes, your dissertation represents a unique opportunity to contribute original research that can influence policy, improve financial models, and shape academic discourse. At DissertationAssist.com, we understand the challenges associated with writing a dissertation in behavioral economics. Our team of experienced academic professionals is dedicated to guiding you through every phase of your research journey, ensuring that your work is methodologically robust, theoretically sound, and articulated with clarity and precision.

Unlocking the Potential of Behavioral Economics Research

Behavioral economics challenges traditional assumptions by incorporating insights from psychology into economic theory. It explores how cognitive biases, emotions, and social influences affect decision-making and market behavior. An effective dissertation in this field not only deepens our understanding of economic phenomena but also provides actionable insights that can inform policy and drive innovation in financial markets.

Why Your Dissertation MattersA well-executed behavioral economics dissertation can serve as a stepping stone for your future academic and professional career. Here’s why your research is so important:

- Advancing Theory: Your work can challenge conventional economic theories by integrating psychological insights, leading to more comprehensive models of decision-making.

- Practical Implications: Evidence-based insights from your research can inform policies, improve consumer protection measures, and enhance market efficiency.

- Influencing Business Practices: By uncovering the hidden drivers of consumer behavior, your findings can help businesses develop more effective marketing and pricing strategies.

- Enhancing Academic and Professional Opportunities: A robust dissertation demonstrates your expertise and analytical skills, paving the way for academic positions, consulting roles, and leadership opportunities in various sectors.

- Global Relevance: With human behavior influencing economic outcomes worldwide, your research has the potential to impact policies and practices on an international scale.

Whether you are exploring decision-making under uncertainty, the role of heuristics in financial markets, or the interplay between social norms and consumer behavior, your dissertation is your opportunity to leave a lasting imprint on the field of behavioral economics.

Our Comprehensive Behavioral Economics Dissertation Help Services

At DissertationAssist.com, our Behavioral Economics Dissertation Help service is designed to support you throughout every stage of your dissertation process. We offer a comprehensive suite of services that ensure your research is both innovative and rigorous. Below is an overview of our key service areas:

Personalized Consultation and Topic RefinementEvery successful dissertation begins with a well-defined topic and clear research objectives. Our personalized consultation sessions are tailored to help you:

- Identify Your Research Interests: We start by discussing your academic background, professional experiences, and personal interests. Whether you’re drawn to consumer behavior, decision-making biases, or the influence of social factors on economic choices, we help you pinpoint topics that resonate with your vision.

- Refine Your Research Question: With expert guidance, we help narrow broad subject areas into focused, researchable questions. Our advisors ensure that your topic is innovative, feasible, and capable of making a significant contribution to behavioral economics.

- Establish Clear Objectives and Hypotheses: Together, we set specific research aims and testable hypotheses that will guide your study. Clear objectives provide direction and demonstrate the potential impact of your research.

- Develop a Detailed Roadmap: We work with you to create a comprehensive timeline that outlines every stage of your dissertation—from proposal development and literature review to data collection, analysis, and final submission. This roadmap helps you stay organized and ensures you meet all critical deadlines.

Establishing a strong foundation through personalized consultation is the first critical step toward a dissertation that is both insightful and influential.

In-Depth Literature Review SupportA thorough literature review is the backbone of any high-quality dissertation. It situates your research within the existing academic dialogue and highlights the originality of your inquiry. Our literature review support includes:

- Access to Premier Sources: We assist you in locating and accessing high-quality academic journals, books, conference proceedings, and industry reports relevant to behavioral economics.

- Critical Analysis and Synthesis: Our experts guide you in critically analyzing the existing literature, identifying key debates, and synthesizing diverse perspectives to build a robust theoretical framework.

- Organized Structuring: We provide strategies for organizing your literature review in a logical and coherent manner that supports your research objectives and reveals gaps in current knowledge.

- Establishing Theoretical Foundations: By linking your research to established theories and models—such as prospect theory, heuristics, and social influence models—you create a solid foundation that underscores the significance of your study.

A well-structured literature review demonstrates your depth of understanding and positions your research as a valuable contribution to the field of behavioral economics.

Methodology Design and Data Collection GuidanceThe methodology section is crucial as it details how you will collect and analyze data to answer your research questions. Our support in this phase includes:

- Choosing the Appropriate Research Design: Whether your study is quantitative (e.g., econometric analysis, experiments), qualitative (e.g., case studies, interviews), or mixed methods, we help you select the design that best fits your research objectives.

- Developing Data Collection Strategies: We assist you in designing robust data collection procedures—such as surveys, experiments, and archival research—that are reliable, valid, and aligned with your research questions.

- Ensuring Ethical Compliance: Our team ensures that your research adheres to ethical guidelines, including obtaining necessary approvals, protecting participant confidentiality, and responsibly managing sensitive data.

- Utilizing Advanced Tools: Leverage modern analytical tools and software (such as R, Python, SPSS, or specialized econometric programs) to efficiently manage and analyze your data, ensuring your methodology is both modern and rigorous.

A robust methodology enhances the credibility of your research, ensuring that your findings are reliable, reproducible, and defensible in academic settings.

Advanced Data Analysis and InterpretationAfter data collection, the next step is to analyze and interpret your findings effectively. Our data analysis support includes:

- Applying Advanced Analytical Techniques: We help you employ sophisticated statistical methods, econometric models, and machine learning algorithms to process your data accurately.

- Interpreting Complex Data: Our experts work with you to transform raw data into meaningful insights. By identifying trends, correlations, and significant patterns, you can address your research questions with confidence.

- Creating Informative Visuals: Develop clear and compelling charts, graphs, and tables that effectively illustrate your findings, making your analysis accessible and persuasive.

- Drawing Evidence-Based Conclusions: Ensure that your conclusions are firmly supported by your empirical evidence and aligned with your research objectives, reinforcing the impact and relevance of your study.

Effective data analysis is the bridge between your research and its practical implications, showcasing the significance of your work and providing a strong foundation for your final discussion.

Professional Writing and Structuring SupportClear and compelling writing is essential for communicating your research effectively. Our professional writing support services include:

- Developing a Coherent Outline: We help you create a detailed outline that organizes your dissertation into logically structured chapters—including the introduction, literature review, methodology, results, discussion, and conclusion—ensuring a seamless narrative.

- Academic Writing Excellence: Our experienced academic writers provide detailed feedback on your drafts, ensuring that your language is precise, your arguments are coherent, and your work adheres to the highest scholarly standards.

- Rigorous Editing and Proofreading: We conduct extensive editing and proofreading to eliminate grammatical errors, enhance sentence structure, and ensure that your formatting and citation styles meet all institutional guidelines.

- Enhancing Clarity and Persuasiveness: Our guidance ensures that your dissertation is engaging and persuasive, clearly conveying the significance and implications of your research to both academic and industry audiences.

A well-crafted dissertation is a testament to your scholarly abilities and significantly enhances your prospects for academic and professional success.

Quality Assurance and Final ReviewBefore submission, your dissertation must be meticulously refined. Our quality assurance services include:

- Comprehensive Proofreading: We carefully proofread your dissertation to catch any typographical, grammatical, or formatting errors, ensuring a flawless final document.

- Integrated Chapter Review: Our experts assess the cohesion and consistency of your dissertation, ensuring that each chapter transitions smoothly and that your overall narrative is logical and compelling.

- Defense Preparation: We offer targeted advice and conduct mock defense sessions to help you prepare for your dissertation defense, equipping you with the skills and confidence needed to present your research effectively.

- Final Quality Check: A final review confirms that your dissertation adheres to all academic guidelines and is fully prepared for submission, providing you with peace of mind and confidence.

Our rigorous quality assurance process is the final step in ensuring that your dissertation is of exceptional quality and ready to make a significant impact in behavioral economics.

Ongoing Mentorship and Post-Submission SupportOur commitment to your success extends well beyond the dissertation writing process. We offer ongoing mentorship and post-submission support to help you achieve long-term success, including:

- Dissertation Defense Coaching: Receive expert coaching on how to develop a compelling defense presentation, manage challenging questions, and articulate your research findings with clarity and confidence.

- Publication Guidance: We provide advice on transforming your dissertation into journal articles or conference presentations, helping you disseminate your research to a broader audience.

- Career Counseling: Personalized career counseling services help you leverage your dissertation for academic and professional opportunities, whether in academia, research institutions, or policy-making roles.

- Long-Term Mentorship: Our support remains available even after submission, ensuring that you have a trusted partner as you transition from academic research to professional practice.

Our ongoing mentorship ensures that you are not only equipped to complete your dissertation but also well-prepared to succeed in your future career in behavioral economics.

The Comprehensive Journey of a Behavioral Economics Dissertation

Writing a dissertation in behavioral economics is a challenging yet immensely rewarding endeavor. Our step-by-step approach provides you with a clear roadmap from the initial concept to the final defense.

Step 1: Topic Selection and Proposal Development- Exploration and Brainstorming: Begin by exploring potential topics that address key behavioral phenomena—such as decision-making biases, consumer behavior, or social influences on economic choices—and identify areas where your research can make a significant contribution.

- Expert Consultation: Engage with our academic advisors to refine your ideas and select a topic that is both innovative and feasible. This foundational stage is crucial for establishing a clear research focus.

- Proposal Writing: Develop a detailed research proposal outlining your objectives, hypotheses, methodology, and anticipated contributions. A well-crafted proposal lays the groundwork for a successful dissertation.

- Comprehensive Research: Gather an extensive range of sources, including academic journals, books, conference papers, and industry reports, to build a comprehensive background for your study.

- Critical Synthesis: Analyze existing literature to identify gaps, reconcile conflicting findings, and construct a robust theoretical framework that supports your research questions.

- Logical Organization: Structure your literature review to create a compelling narrative that justifies your research and establishes its relevance within the broader field of behavioral economics.

- Selecting the Research Design: Decide whether your study will utilize quantitative methods (e.g., experiments, surveys, econometric modeling), qualitative methods (e.g., case studies, interviews, observational research), or a mixed-methods approach.

- Developing Data Collection Methods: Create detailed procedures for collecting both primary and secondary data, ensuring that your methods are reliable, valid, and tailored to address your research questions.

- Ethical Considerations: Ensure that your study adheres to ethical guidelines, including obtaining informed consent, protecting participant confidentiality, and responsibly managing sensitive data.

- Leveraging Technology: Utilize advanced analytical tools and software to facilitate efficient data collection and management, ensuring your methodology is robust and contemporary.

- Processing the Data: Apply advanced statistical and econometric techniques, or qualitative analysis methods, to process your data accurately and derive meaningful results.

- Interpreting Findings: Work with our experts to transform raw data into actionable insights by identifying patterns, trends, and significant correlations that address your research questions.

- Visualizing Data: Develop clear and informative visual representations—such as charts, graphs, and tables—that effectively illustrate your findings and support your conclusions.

- Drawing Evidence-Based Conclusions: Ensure that your conclusions are firmly supported by empirical evidence and aligned with your research objectives, contributing valuable insights to the field.

- Drafting Your Dissertation: Write your dissertation with clarity and precision, ensuring that each chapter (introduction, literature review, methodology, results, discussion, conclusion) is well-organized and contributes to a cohesive overall narrative.

- Revising and Refining: Revise your drafts based on detailed feedback from advisors and peers, continuously improving the clarity, depth, and scholarly rigor of your work.

- Final Proofreading: Conduct extensive editing and proofreading to produce a polished final document that adheres to all academic formatting and citation guidelines.

- Preparing for Your Defense: Develop a persuasive presentation of your research findings, practice your defense through mock sessions, and refine your communication skills to confidently articulate your insights.

- Exploring Publication Prospects: Identify opportunities to publish your research as journal articles or present it at conferences, expanding the reach and impact of your findings.

- Leveraging Your Dissertation for Career Growth: Utilize your completed dissertation as a platform for academic and professional advancement, showcasing your expertise and contributing to the field of behavioral economics.

Why Choose DissertationAssist.com for Your Behavioral Economics Dissertation?

At DissertationAssist.com, we are committed to empowering you to achieve academic excellence in behavioral economics. Our comprehensive services and personalized support make us the ideal partner for your dissertation journey. Here’s why our clients choose us:

- Expert Guidance: Our team comprises experienced researchers, academic professionals, and industry experts with deep knowledge of behavioral economics and its interdisciplinary applications.

- Customized Support: We tailor our services to meet your unique research needs, ensuring that your dissertation is both innovative and methodologically rigorous.

- Access to Cutting-Edge Resources: Benefit from access to premium research databases, advanced analytical tools, and the latest scholarly insights that keep you at the forefront of your field.

- Proven Track Record: Thousands of students have successfully completed their dissertations with our assistance, earning top marks and advancing their careers in academia, industry, and policy-making.

- Commitment to Integrity: We uphold the highest standards of academic integrity, ensuring that your work is original, well-cited, and ethically conducted.

- Ongoing Mentorship: Our support extends beyond the dissertation process, offering continuous mentorship, defense preparation, and career counseling to guide your long-term success.

Our dedicated team is passionate about helping you navigate the complexities of behavioral economics research and transforming your ideas into a groundbreaking dissertation that can shape future policy, business practices, and academic thought.

Final Thoughts

A behavioral economics dissertation is not merely an academic milestone—it is a transformative opportunity to explore the intricacies of human decision-making and contribute innovative insights to a field that influences both public policy and market behavior. With DissertationAssist.com by your side, you gain access to the expertise, resources, and personalized support necessary to produce a dissertation that meets the highest academic standards and makes a lasting impact.

Whether you are just beginning your research journey or preparing for your final defense, our comprehensive services are designed to empower you to innovate, excel, and lead in this dynamic field. Take the first step toward academic excellence and future career success by contacting DissertationAssist.com today for your free consultation. Discover how our Behavioral Economics Dissertation Help can transform your research journey into a pathway for groundbreaking contributions to the study of economic behavior and decision-making.

DissertationAssist.com – Empowering Behavioral Economics Scholars to Innovate, Excel, and Shape the Future of Economic Policy and Market Dynamics.

Below are 100 Behavioral Economics Dissertation Topics

-

The Impact of Cognitive Biases on Consumer Spending:

Investigate how cognitive biases (such as loss aversion and anchoring) influence consumer spending habits, altering purchasing decisions and challenging traditional rational choice theories. -

Behavioral Nudges and Financial Decision-Making:

Examine how nudges—small design changes in choice architecture—influence individual financial decisions, encouraging savings and prudent investment behaviors in various economic contexts. -

Heuristics in Investment Choices:

Analyze the role of heuristics (rules of thumb) in shaping investor behavior, exploring how mental shortcuts impact risk perception and decision-making in financial markets. -

Time Inconsistency and Procrastination in Savings Behavior:

Investigate how time inconsistency leads to procrastination in saving, and evaluate interventions that could align short-term actions with long-term financial goals. -

Social Norms and Their Influence on Economic Behavior:

Examine how social norms shape economic decisions, focusing on peer influences, conformity, and the role of societal expectations in consumption and saving patterns. -

The Role of Emotions in Economic Decision-Making:

Analyze how emotional responses affect economic choices, influencing risk tolerance, spending behavior, and investment decisions beyond purely rational calculations. -

Behavioral Biases in Credit Card Usage:

Investigate how behavioral biases (e.g., optimism bias, framing effects) lead to suboptimal credit card usage and increased debt, suggesting strategies to promote financial wellness. -

Impact of Overconfidence on Market Trading:

Examine how overconfidence among traders affects market dynamics, leading to excessive risk-taking, mispricing, and eventual market corrections. -

Anchoring Effects in Price Perception:

Analyze how initial price information acts as an anchor that influences consumers’ subsequent price evaluations and purchasing decisions in retail environments. -

Loss Aversion and Risk Behavior in Financial Markets:

Investigate how the fear of losses drives risk-averse behavior among investors, influencing portfolio management and market volatility. -

Mental Accounting and Its Effects on Budgeting:

Examine how mental accounting—the categorization of money into separate accounts—affects spending, saving, and overall financial decision-making. -

Status Quo Bias in Economic Choices:

Analyze the tendency of individuals to prefer the status quo, even when alternatives may offer improved outcomes, and its implications for market efficiency. -

Framing Effects in Marketing and Consumer Behavior:

Investigate how different framing techniques in advertising influence consumer perceptions and decision-making, altering responses to the same product information. -

Present Bias in Health and Financial Decisions:

Examine how present bias—the tendency to overvalue immediate rewards—affects health choices and long-term financial planning, undermining optimal decision-making. -

Behavioral Interventions to Improve Retirement Savings:

Explore how behavioral interventions such as automatic enrollment and default options can enhance retirement savings and secure long-term financial stability. -

Impact of Social Comparison on Spending Behavior:

Investigate how social comparison influences spending patterns, as individuals adjust their consumption based on comparisons with peers and societal standards. -

Behavioral Determinants of Loan Default Rates:

Examine how behavioral factors, including optimism bias and overconfidence, contribute to loan defaults, and suggest strategies to mitigate these risks. -

The Role of Trust in Financial Decision-Making:

Analyze how trust in financial institutions and advisors affects consumer behavior, investment decisions, and the overall stability of financial markets. -

Behavioral Insights into Charitable Giving:

Investigate how behavioral economics principles influence charitable donations, including the effects of framing, social influence, and default options on giving behavior. -

Effects of Scarcity Mindset on Consumer Behavior:

Examine how perceptions of scarcity drive consumer behavior, leading to impulsive buying and increased demand, even when supply is sufficient. -

Behavioral Finance and Asset Pricing Anomalies:

Analyze how behavioral factors explain asset pricing anomalies, challenging classical finance theories and offering insights into market inefficiencies. -

The Influence of Peer Effects on Savings Rates:

Investigate how peer influences affect individual saving behaviors, exploring how social networks and community norms shape financial habits. -

Impact of Financial Literacy on Behavioral Biases:

Examine how higher levels of financial literacy mitigate behavioral biases, leading to better financial decisions and improved economic outcomes. -

Behavioral Factors in Market Bubbles and Crashes:

Analyze how irrational behavior and herding contribute to the formation and bursting of market bubbles, and explore policy interventions to stabilize markets. -

The Role of Defaults in Promoting Financial Welfare:

Investigate how default options in retirement plans and savings accounts improve participation rates and enhance long-term financial security. -

Behavioral Insights into Consumer Credit Decisions:

Examine how behavioral biases such as anchoring and loss aversion influence decisions related to consumer credit, impacting debt levels and financial health. -

Effectiveness of Incentive-Based Interventions in Financial Behavior:

Analyze how incentive programs can be designed to encourage better saving and spending habits, using insights from behavioral economics. -

The Impact of Friction on Consumer Decision-Making:

Investigate how transactional friction—such as delays, fees, or complex processes—affects consumer behavior and decision-making efficiency. -

Role of Behavioral Economics in Designing Effective Tax Policies:

Examine how insights from behavioral economics can inform the design of tax policies that improve compliance and reduce the distortions in economic decision-making. -

Behavioral Determinants of Investment Diversification:

Investigate how behavioral biases, including overconfidence and status quo bias, affect investors’ decisions to diversify their portfolios. -

The Influence of Marketing Strategies on Consumer Impulsivity:

Analyze how marketing techniques, such as limited-time offers and scarcity cues, trigger impulsive purchasing behavior and affect consumer welfare. -

Behavioral Economics and the Adoption of Fintech Innovations:

Examine how behavioral factors influence the adoption and usage of fintech services, including mobile payments, digital wallets, and online banking. -

Impact of Behavioral Biases on Financial Regulation Compliance:

Investigate how cognitive biases influence compliance with financial regulations and propose strategies to enhance adherence and improve market stability. -

Behavioral Insights into Investment Decision-Making Under Uncertainty:

Analyze how risk aversion and ambiguity affect investor choices in uncertain environments, and explore strategies to improve decision-making. -

The Role of Behavioral Nudges in Reducing Impulse Buying:

Examine how nudges can be implemented to curb impulse buying, encouraging more deliberate and informed financial decisions. -

Behavioral Economics of Pricing Strategies:

Investigate how pricing strategies that leverage behavioral cues influence consumer purchasing decisions and market demand. -

Impact of Social Media on Investor Sentiment:

Analyze how social media platforms and online forums influence investor sentiment, market behavior, and the formation of financial bubbles. -

Behavioral Factors in Pension Plan Participation:

Examine the reasons behind low participation rates in pension plans, focusing on behavioral biases such as present bias and inertia. -

The Role of Loss Aversion in Portfolio Management:

Investigate how the fear of losses influences portfolio management decisions, leading to risk-averse behavior and affecting investment performance. -

Behavioral Insights into Stock Market Anomalies:

Analyze how behavioral factors contribute to market anomalies, such as momentum and contrarian effects, challenging traditional financial models. -

Impact of Peer Pressure on Investment Decisions:

Examine how peer pressure and social comparisons influence individual investment choices and risk-taking behaviors in financial markets. -

Role of Financial Incentives in Modifying Consumer Behavior:

Investigate how different types of financial incentives (cashback, discounts, rewards) can modify consumer behavior and enhance economic outcomes. -

Behavioral Determinants of Saving and Spending Patterns:

Analyze how behavioral biases shape saving and spending habits, and evaluate interventions designed to promote long-term financial stability. -

The Influence of Default Options on Investment Choices:

Examine how default settings in retirement and investment plans affect participant choices, leading to improved savings rates and diversified portfolios. -

Behavioral Economics in Predicting Consumer Responses to Market Shocks:

Investigate how behavioral models can predict consumer reactions during market shocks and economic downturns, enhancing policy responses. -

The Role of Financial Education in Reducing Behavioral Biases:

Examine how targeted financial education programs can mitigate the effects of behavioral biases, leading to more rational financial decision-making. -

Behavioral Insights into Mortgage Lending Practices:

Analyze how behavioral factors influence mortgage applications, default rates, and lending practices, proposing interventions to improve borrower outcomes. -

Impact of Cognitive Dissonance on Investment Behavior:

Investigate how cognitive dissonance affects investor decisions and market reactions, and explore strategies to resolve dissonance for better financial choices. -

The Role of Social Norms in Shaping Savings Behavior:

Examine how social norms and peer comparisons drive individual saving habits, influencing long-term financial security and consumer welfare. -

Behavioral Biases and Their Impact on Credit Decisions:

Analyze how biases such as anchoring and confirmation bias affect credit decisions, potentially leading to suboptimal borrowing and lending outcomes. -

Role of Time Preferences in Economic Decision-Making:

Investigate how time preferences and present bias influence consumer choices between immediate and delayed rewards, affecting savings and investment decisions. -

Behavioral Economics and the Efficacy of Financial Nudges:

Examine the impact of financial nudges on behavior, assessing their effectiveness in promoting savings, reducing debt, and encouraging prudent financial decisions. -

The Impact of Overconfidence on Market Bubbles:

Investigate how overconfidence among investors contributes to market bubbles, exploring the dynamics of speculative behavior and subsequent market corrections. -

Behavioral Factors in Retail Price Perception:

Analyze how consumer price perceptions are influenced by behavioral biases and marketing strategies, affecting spending and brand loyalty in retail markets. -

Role of Behavioral Economics in Corporate Finance Decisions:

Examine how behavioral insights inform corporate finance decisions, influencing capital budgeting, risk assessment, and investment strategies. -

Impact of Social Proof on Financial Decision-Making:

Investigate how social proof—the influence of others' behavior—affects individual financial decisions, such as investments and purchasing, in uncertain markets. -

Behavioral Determinants of Portfolio Diversification:

Analyze how biases like status quo bias and herding behavior affect the degree of diversification in investment portfolios and overall risk management. -

The Role of Emotions in Market Volatility:

Examine how emotional reactions among investors contribute to market volatility, and explore strategies to mitigate these effects through behavioral interventions. -

Impact of Behavioral Economics on Consumer Loan Repayment:

Investigate how behavioral biases influence loan repayment behavior, assessing interventions that encourage timely repayments and reduce default risks. -

The Influence of Cognitive Load on Financial Decision-Making:

Analyze how cognitive load affects decision quality, leading to suboptimal financial choices and exploring strategies to simplify decision processes. -

Behavioral Factors in Financial Market Participation:

Examine why some individuals choose not to participate in financial markets, focusing on risk aversion, lack of confidence, and other behavioral barriers. -

The Role of Behavioral Economics in Retirement Planning:

Investigate how behavioral insights can improve retirement planning strategies, encouraging higher savings rates and better long-term financial outcomes. -

Impact of Default Bias on Investment Fund Selection:

Examine how default bias influences investor decisions when selecting mutual funds or retirement accounts, and assess strategies to encourage more diversified choices. -

Behavioral Insights into Consumer Debt Accumulation:

Analyze how psychological factors such as over-optimism and impulsivity contribute to consumer debt accumulation and explore interventions to promote financial responsibility. -

The Role of Loss Aversion in Savings Behavior:

Investigate how loss aversion drives savings behavior, influencing the balance between immediate consumption and long-term financial planning. -

Behavioral Economics and Market Reaction to Financial News:

Examine how investor sentiment and cognitive biases influence market reactions to financial news, affecting stock prices and trading volumes. -

Impact of Financial Framing on Investment Decisions:

Analyze how the framing of financial information—such as gains versus losses—affects investment choices and risk-taking behaviors. -

Behavioral Determinants of Consumer Financial Product Adoption:

Investigate how behavioral biases influence the adoption of financial products, such as credit cards and insurance, and how companies can design better products. -

The Role of Financial Self-Control in Consumer Behavior:

Examine how individual differences in self-control impact spending, saving, and investment decisions, and explore interventions to improve financial self-regulation. -

Behavioral Insights into the Use of Financial Planning Tools:

Analyze how the design and usability of financial planning tools affect their adoption and effectiveness, enhancing consumer financial decision-making. -

Impact of Social Networks on Investment Behavior:

Investigate how social networks and peer influences shape investment decisions, leading to herding behavior and market trends. -

Role of Behavioral Biases in Stock Market Overreactions:

Examine how biases such as confirmation bias and anchoring contribute to market overreactions during periods of volatility, impacting investment strategies. -

Behavioral Economics and the Efficiency of Capital Markets:

Analyze how behavioral factors contribute to inefficiencies in capital markets, challenging the assumptions of rational market behavior. -

The Role of Cognitive Biases in Entrepreneurial Financing Decisions:

Investigate how cognitive biases affect the decisions of entrepreneurs seeking financing, impacting startup success and venture capital investments. -

Impact of Behavioral Interventions on Financial Decision-Making:

Examine the effectiveness of behavioral interventions (nudges, default options) in improving financial decision-making and promoting better economic outcomes. -

Behavioral Economics in Evaluating Investment Risk:

Investigate how investors perceive and evaluate risk through the lens of behavioral biases, and explore strategies to encourage more balanced risk assessments. -

Role of Time Preferences in Savings and Consumption:

Analyze how time discounting and present bias influence the trade-off between immediate consumption and long-term savings. -

Impact of Cognitive Biases on Consumer Spending during Economic Downturns:

Examine how behavioral biases affect consumer spending during recessions, influencing recovery and market stabilization. -

Behavioral Determinants of Financial Market Entry:

Investigate why certain demographics avoid financial markets due to perceived complexity or risk, and propose interventions to enhance participation. -

Role of Default Options in Enhancing Financial Security:

Examine how well-designed default options in savings and investment plans can increase participation and long-term financial security. -

Behavioral Insights into Credit Card Debt Management:

Investigate how psychological factors contribute to credit card debt accumulation and evaluate strategies to promote responsible debt management. -

Impact of Emotional Decision-Making on Investment Portfolio Performance:

Analyze how emotional factors influence portfolio adjustments and overall investment performance, exploring methods to mitigate detrimental effects. -

Role of Financial Literacy in Mitigating Behavioral Biases:

Examine how improved financial education reduces the impact of behavioral biases, leading to more rational and beneficial financial decisions. -

Behavioral Economics and the Adoption of Sustainable Financial Practices:

Investigate how behavioral insights can promote sustainable financial behaviors among consumers, including responsible investing and ethical spending. -

Impact of Default Bias on Consumer Loan Management:

Examine how default bias influences loan management, including repayment behaviors and refinancing decisions, and propose strategies for improvement. -

Role of Behavioral Insights in Enhancing Investment Strategies:

Analyze how incorporating behavioral economics principles can lead to improved investment strategies and better risk management. -

Impact of Financial Overconfidence on Market Performance:

Investigate how overconfidence among investors affects trading behavior, leading to market inefficiencies and influencing asset prices. -

Behavioral Factors Influencing Stock Market Participation:

Examine why certain individuals refrain from participating in stock markets due to behavioral biases, and suggest interventions to promote engagement. -

The Role of Framing Effects in Consumer Financial Choices:

Analyze how different framing techniques influence consumer decisions regarding savings, investments, and spending. -

Behavioral Economics and the Success of Crowdfunding Platforms:

Investigate how behavioral biases and social influence drive the success of crowdfunding initiatives, impacting funding outcomes and investor behavior. -

Impact of Social Proof on Financial Product Adoption:

Examine how social proof and peer recommendations affect the adoption of financial products, such as loans, insurance, and investment services. -

Role of Loss Aversion in Consumer Price Sensitivity:

Analyze how loss aversion influences consumer sensitivity to price changes and discounts, affecting purchasing decisions in competitive markets. -

Behavioral Determinants of Retirement Savings Behavior:

Investigate how behavioral biases, including present bias and inertia, impact retirement savings decisions and long-term financial security. -

Impact of Cognitive Load on Financial Decision Quality:

Examine how high cognitive load and information overload affect the quality of financial decisions and suggest ways to simplify complex choices. -

Behavioral Economics in Analyzing Market Sentiment:

Investigate how market sentiment, driven by behavioral factors, influences stock price movements and investor behavior during periods of volatility. -

Role of Behavioral Interventions in Reducing Financial Mismanagement:

Examine how targeted behavioral interventions can reduce instances of financial mismanagement and promote sound economic practices. -

Impact of Personalized Financial Advice on Investment Decisions:

Analyze how tailored financial advice, informed by behavioral insights, enhances investor decision-making and improves portfolio performance. -

Behavioral Insights into Financial Crisis Recovery:

Investigate how behavioral factors influence consumer and investor behavior during financial crises, and propose measures to facilitate recovery and market stabilization. -

The Role of Peer Influence in Shaping Financial Norms:

Examine how peer influence and social norms affect financial behaviors, such as saving and spending, and assess strategies to foster positive financial practices. -

Behavioral Economics and the Future of Digital Finance:

Explore how emerging digital finance platforms integrate behavioral economics principles to improve user experience, financial decision-making, and overall market efficiency.

Each topic is designed as a research-ready statement that highlights critical issues in behavioral economics, with key terms emphasized in bold to enhance clarity and focus. Feel free to modify or refine any topic to better align with your specific research interests or institutional requirements.