Expert Monetary Policy Dissertation Help

Introduction

In today’s rapidly changing global economy, monetary policy plays a crucial role in shaping financial stability, inflation, economic growth, and international competitiveness. However, undertaking a dissertation on monetary policy is no easy feat. The subject is inherently complex—demanding a deep understanding of macroeconomic theory, quantitative analysis, and contemporary policy debates. At DissertationAssist.com, we recognize the challenges that come with exploring monetary policy and provide comprehensive dissertation help designed specifically for students delving into this fascinating field.

Our expert team—comprising seasoned economists, academic researchers, and professional writers—offers personalized assistance throughout every phase of your dissertation. Whether you need guidance on formulating research questions, constructing robust econometric models, synthesizing theoretical frameworks, or interpreting empirical data, our services are tailored to help you produce a dissertation that is both academically rigorous and policy-relevant.

This webpage provides an in-depth overview of our monetary policy dissertation help services. We’ll walk you through the common challenges faced by students in this field, detail our step-by-step process, and highlight why partnering with DissertationAssist.com can be the key to your academic success.

Understanding Monetary Policy and Its Dissertation Challenges

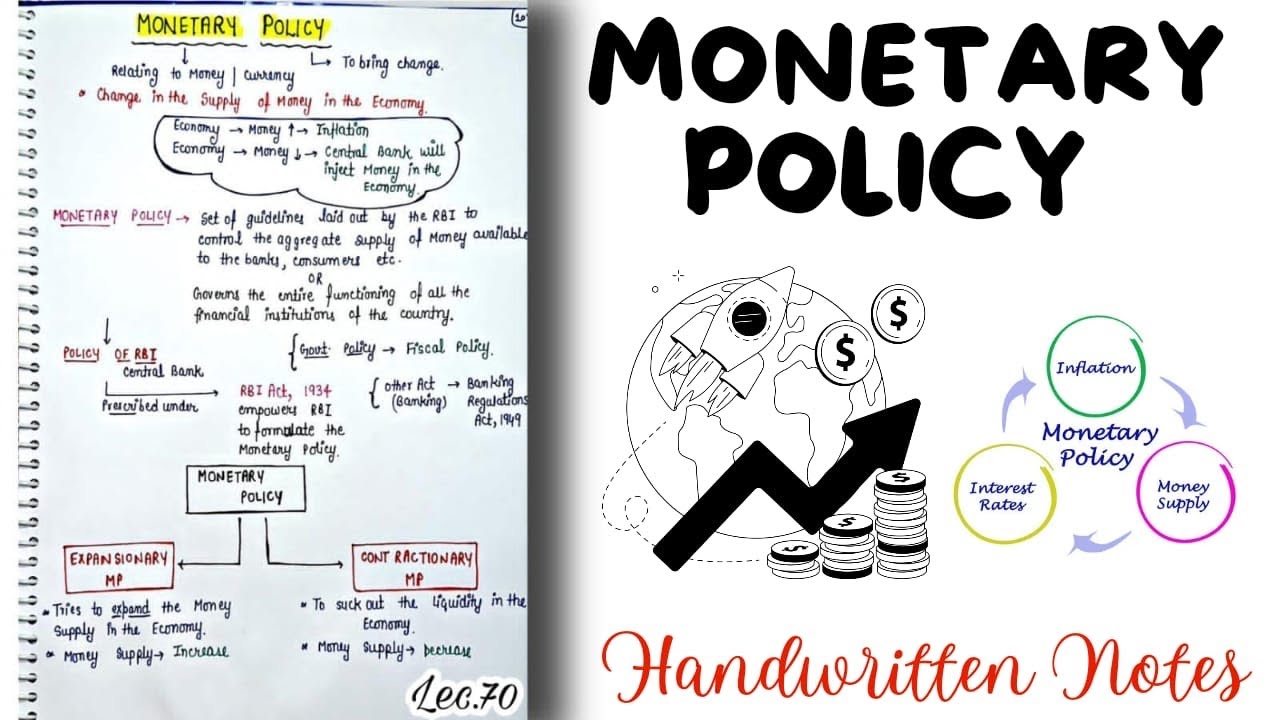

What is Monetary Policy?Monetary policy refers to the actions undertaken by central banks and monetary authorities to control the money supply, manage interest rates, and influence economic activity. It is a cornerstone of macroeconomic management and involves complex decision-making processes aimed at maintaining price stability, achieving full employment, and fostering sustainable economic growth. A dissertation on monetary policy might examine topics ranging from inflation targeting and interest rate adjustments to the transmission mechanisms of monetary policy and its impact on financial markets.

Why a Monetary Policy Dissertation Can Be ChallengingDissertations on monetary policy involve several unique challenges, including:

-

Theoretical Complexity:

Monetary policy theories—such as Keynesian, monetarist, and new Keynesian frameworks—are dense and multifaceted. Crafting a dissertation in this area requires a robust grasp of complex economic models, historical context, and evolving policy debates. -

Quantitative Analysis and Empirics:

Research in monetary policy often necessitates sophisticated econometric techniques and data analysis. Whether you are modeling interest rate effects, inflation dynamics, or financial market responses, you must be proficient in statistical software and quantitative methods. -

Interdisciplinary Nature:

Monetary policy intersects with various disciplines including finance, international economics, and political economy. Integrating these perspectives into a cohesive dissertation demands interdisciplinary thinking and comprehensive literature reviews. -

Rapidly Evolving Policy Landscape:

Global financial systems and central banking practices are constantly evolving. Keeping abreast of recent policy changes, new research findings, and emerging market trends is essential—and challenging—for any dissertation researcher. -

Data Collection and Analysis:

Reliable data is the foundation of empirical research. However, obtaining and processing macroeconomic data—from central banks, international organizations, and government agencies—can be time-consuming and technically demanding.

At DissertationAssist.com, our specialized support is designed to help you overcome these challenges by offering expert guidance at every step of your research journey.

Our Monetary Policy Dissertation Help Services

Personalized Consultation and Topic SelectionA successful dissertation begins with selecting a compelling and original topic. Our expert consultants will work with you to:

- Explore current monetary policy debates, such as unconventional monetary policy, digital currencies, and inflation targeting.

- Identify gaps in the existing literature and assess the feasibility of potential research questions.

- Develop clear, focused research objectives and hypotheses that align with your academic interests and career aspirations.

Through one-on-one consultations, we ensure your dissertation topic is not only academically rigorous but also timely and relevant to current monetary policy discussions.

Comprehensive Literature Review and Theoretical FrameworkA thorough literature review is essential for grounding your research in the broader academic debate. Our services include:

- Source Identification: Helping you locate high-quality academic journals, books, policy reports, and working papers related to monetary policy.

- Critical Analysis: Assisting in synthesizing diverse viewpoints, theoretical models, and empirical findings to build a robust theoretical framework.

- Research Gap Identification: Highlighting areas where your research can contribute new insights to ongoing debates in monetary policy and macroeconomics.

We guide you in constructing a literature review that not only demonstrates mastery of the subject but also lays a strong foundation for your own research.

Research Design and Methodology DevelopmentDesigning a robust research methodology is critical for addressing your research questions effectively. Our experts will help you:

- Select Appropriate Methods: Choose between quantitative, qualitative, or mixed-methods approaches based on your research objectives.

- Develop Econometric Models: Formulate and refine econometric models to analyze central bank policies, interest rate changes, and their effects on inflation and growth.

- Data Collection Strategies: Identify reliable sources for macroeconomic data, including central bank databases, international financial institutions, and governmental agencies.

- Ensure Replicability: Design your study so that it meets high academic standards of replicability and validity, which is crucial for empirical research in monetary policy.

By refining your research design and methodology, we empower you to conduct rigorous and impactful research.

Data Analysis and Interpretation SupportMonetary policy dissertations often involve complex data analysis. Our technical support services include:

- Statistical Software Guidance: Assistance with using econometric software packages such as EViews, Stata, R, or MATLAB for data analysis.

- Advanced Econometric Techniques: Help with techniques like time-series analysis, vector autoregression (VAR), cointegration tests, and impulse response functions.

- Data Visualization: Guidance in creating clear, informative charts, graphs, and tables that effectively communicate your findings.

- Result Interpretation: Expert help in interpreting the results of your analyses in the context of existing monetary theory and policy debates.

Our goal is to ensure that your empirical findings are robust, clearly presented, and contribute meaningfully to the academic discourse on monetary policy.

Writing, Editing, and ProofreadingThe final step in your dissertation journey is transforming your research into a polished, cohesive document. Our writing support includes:

- Drafting Assistance: Collaborating with you to structure your dissertation logically—from the introduction and literature review through methodology, results, and conclusions.

- Expert Editing: In-depth editing to refine your arguments, ensure clarity, and maintain academic tone while addressing both theoretical and technical aspects.

- Proofreading: Comprehensive proofreading to eliminate grammatical, punctuation, and formatting errors, ensuring that your final document meets the highest academic standards.

- Continuous Feedback: Ongoing revisions and feedback sessions to help you fine-tune your work until it is publication-ready.

Our experienced writers and editors work alongside you to ensure that your dissertation is not only rigorous in content but also polished in presentation.

Final Review and Submission GuidanceAs you near the end of your dissertation, the final review is critical. Our services include:

- Comprehensive Review: A final, holistic review of your dissertation to ensure coherence, consistency, and adherence to academic standards.

- Formatting and Citation: Assistance with formatting your document according to your institution’s guidelines and ensuring proper citation of sources in APA, MLA, Chicago, or other required styles.

- Submission Support: Guidance on navigating the submission process, including handling committee feedback and preparing for your defense.

- Post-Submission Assistance: Continued support in addressing any revisions or follow-up queries from your academic board.

With our final review and submission support, you can confidently submit your dissertation, knowing that every detail has been meticulously addressed.

Our Proven Process: Step-by-Step to Dissertation Success

Step 1: Initial ConsultationYour journey with DissertationAssist.com begins with a personalized consultation. During this phase, we:

- Discuss your academic background, research interests, and previous work.

- Identify your key challenges and specific needs related to your monetary policy dissertation.

- Outline a preliminary plan, including potential research questions and objectives.

This initial consultation sets the stage for a customized approach that aligns with your unique academic journey.

Step 2: Customized Project Proposal and PlanningBased on our initial discussions, we help you develop a detailed project proposal and work plan. This includes:

- A clear statement of research objectives, questions, and hypotheses.

- A comprehensive timeline outlining milestones for the literature review, research design, data collection, analysis, writing, and revisions.

- Risk management strategies to address potential challenges such as data limitations or methodological hurdles.

Our transparent planning process ensures that you know what to expect and when, allowing you to manage your time effectively.

Step 3: In-Depth Literature Review and Theoretical Framework DevelopmentWith your project plan in place, we assist you in conducting a thorough literature review:

- Source Compilation: Identifying seminal works, recent research, and policy documents that form the backbone of your study.

- Critical Synthesis: Helping you critically analyze and synthesize the literature to build a robust theoretical framework.

- Identifying Research Gaps: Highlighting areas where your research can provide new insights and contribute to policy debates.

This phase ensures that your dissertation is grounded in a strong theoretical context, enhancing the relevance and impact of your research.

Step 4: Research Design and Methodology ImplementationNext, we focus on designing and implementing a sound research methodology:

- Method Selection: Choosing the most appropriate research methods—whether quantitative, qualitative, or mixed—tailored to your research objectives.

- Model Development: Assisting in the formulation of econometric models to analyze policy impacts, interest rate dynamics, and inflation trends.

- Data Strategy: Developing a strategy for collecting high-quality data from reputable sources and ensuring that your approach meets rigorous academic standards.

- Pilot Testing: If needed, conducting preliminary tests to validate your research design and refine your methodology.

By laying a solid methodological foundation, we help ensure that your research is robust, replicable, and capable of producing meaningful results.

Step 5: Data Collection, Analysis, and InterpretationWith your methodology in place, the next phase involves collecting and analyzing data:

- Data Collection: Providing guidance on gathering macroeconomic data from central banks, international organizations, and government agencies.

- Technical Analysis: Offering expert support in using advanced econometric techniques and statistical software to analyze your data.

- Visualization: Helping you create clear visual representations of your findings—charts, graphs, and tables that convey your results effectively.

- Interpretation: Assisting you in interpreting complex empirical results within the context of monetary theory and current policy debates.

This phase is crucial for transforming raw data into insightful conclusions that support your research objectives.

Step 6: Writing, Editing, and Final Draft PreparationOnce your research is complete, the focus shifts to writing your dissertation:

- Structured Writing: Collaboratively developing a clear, logical structure for your dissertation, including a compelling introduction, detailed literature review, rigorous methodology, empirical analysis, and thoughtful conclusions.

- Expert Editing: In-depth editing sessions to refine your arguments, improve clarity, and ensure that the document meets the highest academic standards.

- Proofreading: Meticulous proofreading to correct any grammatical, punctuation, or formatting errors.

- Revision Cycles: Ongoing feedback sessions to ensure that every section of your dissertation is polished and cohesive.

Our collaborative writing process ensures that your final document is not only academically rigorous but also engaging and well-structured.

Step 7: Final Review, Submission, and Post-Submission SupportIn the final stage of your dissertation journey, we provide comprehensive support to ensure a successful submission:

- Holistic Review: A complete review of your dissertation to check for consistency, accuracy, and adherence to institutional guidelines.

- Formatting and Citations: Assistance with final formatting and citation requirements, ensuring that your references are correctly cited and your document is professionally presented.

- Submission Guidance: Detailed advice on the submission process, including strategies for addressing feedback from your committee and preparing for your defense.

- Ongoing Support: Post-submission assistance to help you respond to any additional queries or revisions required by your academic board.

This final phase guarantees that you submit a dissertation that reflects your hard work and scholarly excellence.

Meet Our Expert Team

At DissertationAssist.com, our team is comprised of highly qualified economists, academic researchers, and professional writers with extensive experience in monetary policy and macroeconomics. Here’s what sets our experts apart:

-

Advanced Academic Credentials:

Our consultants hold advanced degrees in economics, finance, and related fields, ensuring that you receive expert guidance grounded in rigorous academic knowledge. -

Industry and Research Experience:

With experience working at central banks, research institutions, and policy organizations, our experts bring practical insights into the complexities of monetary policy and its real-world applications. -

Technical and Quantitative Expertise:

Proficient in advanced econometric techniques and data analysis, our team is well-equipped to help you navigate the quantitative challenges of your dissertation. -

Commitment to Excellence:

We are dedicated to helping you produce original, high-quality work that meets the highest academic standards and contributes meaningfully to policy debates. -

Personalized Support:

Recognizing that every dissertation is unique, we tailor our services to address your specific needs, ensuring comprehensive support from topic selection to final submission.

Our team’s blend of academic rigor, technical prowess, and practical experience makes us the ideal partner for your monetary policy dissertation.

Why Choose DissertationAssist.com for Your Monetary Policy Dissertation?

Choosing the right partner for your dissertation can be the difference between a stressful, uncertain process and a successful, rewarding academic journey. Here’s why DissertationAssist.com is the premier choice for monetary policy dissertation help:

Unparalleled ExpertiseOur team combines deep theoretical knowledge with extensive practical experience in monetary policy. This ensures that your dissertation is informed by the latest research, real-world insights, and robust analytical techniques.

Customized, One-on-One GuidanceWe understand that every dissertation is unique. Our personalized consultations, tailored project plans, and ongoing support mean that your specific research needs and academic goals are always our top priority.

Comprehensive, End-to-End ServiceFrom the initial idea and literature review to data analysis, writing, and final submission, our full-spectrum service covers every aspect of your dissertation journey. Our holistic approach leaves no detail overlooked.

Commitment to Quality and OriginalityWe pride ourselves on maintaining the highest standards of academic integrity. Every dissertation is crafted to be original, thoroughly researched, and meticulously edited, ensuring that your work stands up to rigorous academic scrutiny.

Timely Delivery and Transparent CommunicationDeadlines are critical in academia. Our structured process, clear timelines, and transparent communication ensure that you are always informed of progress, allowing you to manage your schedule effectively.

Competitive Pricing and Reliable SupportQuality dissertation help shouldn’t break the bank. We offer competitive pricing along with reliable, ongoing support—making expert academic assistance accessible without compromising on excellence.

Success Stories and Testimonials

Our clients’ success is our greatest reward. Here are a few testimonials from students who have benefited from our monetary policy dissertation help services:

“DissertationAssist.com transformed my dissertation journey. Their expert guidance on both the theoretical and empirical aspects of monetary policy was invaluable. I was able to produce a work that not only met but exceeded my academic committee’s expectations.”

– Elena R., PhD Candidate in Economics

“I was struggling to reconcile the complexities of monetary theory with the demands of empirical analysis. The team at DissertationAssist.com provided the technical expertise and personalized support that allowed me to complete my dissertation on time and with confidence.”

– Marcus T., Master’s Student in Finance

“Their step-by-step process—from topic selection through data analysis and final revisions—made the entire process manageable. I now have a dissertation that I am truly proud of, and I couldn’t have done it without their support.”

– Sara K., PhD Candidate in Macroeconomics

These testimonials are a testament to our commitment to excellence and our ability to provide tailored, comprehensive support for your monetary policy dissertation.

Frequently Asked Questions (FAQs)

What type of assistance do you offer for a monetary policy dissertation?We offer a full range of services, including topic selection, literature review, research design, quantitative and qualitative analysis, writing, editing, proofreading, and final submission support. Our assistance is tailored to your specific research needs.

How do you ensure the originality and quality of my dissertation?Our team follows strict academic standards and uses reliable plagiarism detection tools to guarantee that your dissertation is 100% original. We focus on creating custom content that is thoroughly researched and meticulously edited for quality.

Can you help me integrate both theoretical and empirical research in my dissertation?Absolutely. Our experts are well-versed in both monetary theory and advanced econometric techniques. We help you develop a cohesive dissertation that effectively integrates theoretical frameworks with robust empirical analysis.

What is the typical turnaround time for your services?The timeline depends on the complexity of your project and the specific services required. During our initial consultation, we will discuss your deadlines and develop a customized work plan that ensures timely delivery without compromising quality.

How do I get started with DissertationAssist.com?Simply reach out through our Contact page or call our support hotline. One of our academic consultants will schedule an initial consultation to discuss your project requirements and explain how we can best support you throughout your dissertation journey.

Is my personal and academic information kept confidential?Yes, confidentiality is our top priority. We adhere to strict privacy policies to ensure that all your personal and academic information remains secure throughout our engagement.

Tips for Maximizing Your Dissertation Success in Monetary Policy

While our expert team is here to guide you, here are some additional strategies to help ensure your dissertation stands out:

-

Start Early and Plan Meticulously:

Develop a detailed timeline with clear milestones. Early planning reduces last-minute stress and ensures that every stage of your dissertation receives the attention it deserves. -

Stay Informed:

Monetary policy is a dynamic field. Keep up with recent policy debates, emerging trends, and scholarly research to ensure your work is current and relevant. -

Engage with Experts:

Attend seminars, webinars, and conferences related to monetary policy. Networking with experts and peers can provide valuable insights and enhance your research perspective. -

Seek Continuous Feedback:

Regularly share drafts with your advisor and our expert consultants. Constructive criticism is key to refining your arguments and strengthening your analysis. -

Embrace Quantitative Rigor:

Ensure that your econometric models are robust and that your data analysis is thorough. The strength of your empirical research will significantly bolster the impact of your dissertation. -

Maintain a Balanced Approach:

While it’s important to be innovative, ensure that your dissertation is grounded in established theories and rigorous methodology. Balancing innovation with academic discipline is critical. -

Take Care of Yourself:

Writing a dissertation is a marathon, not a sprint. Prioritize self-care, maintain a healthy work-life balance, and don’t hesitate to take breaks when needed.

Get Started Today

If you are ready to elevate your monetary policy dissertation and contribute meaningful insights to the field of macroeconomics, DissertationAssist.com is here to help. Our expert team is dedicated to providing personalized, comprehensive support from the initial stages of topic selection to the final submission and beyond.

Take the first step toward transforming your academic challenges into opportunities for success. Contact us today through our website or call our dedicated support hotline to schedule your initial consultation. Let us help you craft a dissertation that not only meets the highest academic standards but also makes a significant impact in the realm of monetary policy.

Conclusion

A dissertation on monetary policy is both challenging and immensely rewarding. It demands an integration of complex theoretical insights, sophisticated quantitative analysis, and a deep understanding of global economic dynamics. At DissertationAssist.com, we are committed to guiding you through every step of this process. Our comprehensive services—ranging from personalized consultations and robust literature reviews to advanced data analysis and meticulous editing—ensure that your dissertation will be a work of academic excellence.

Your academic journey is a crucial investment in your future. With our expert guidance, technical expertise, and personalized support, you can navigate the complexities of monetary policy research with confidence and precision. Trust DissertationAssist.com to be your partner in achieving scholarly excellence and making a lasting contribution to the field of monetary policy.

Thank you for considering our services. We look forward to helping you achieve your academic goals and empowering you to produce a dissertation that sets you apart as a thought leader in the world of monetary policy.

This comprehensive guide provides an in-depth overview of how DissertationAssist.com can support your monetary policy dissertation journey. With expert guidance, personalized support, and a commitment to excellence, we’re here to help you turn your academic challenges into opportunities for success.

Below are 100 detailed monetary policy dissertation topics.

-

The Impact of Interest Rate Adjustments on Economic Growth

This dissertation examines how central bank interest rate adjustments influence economic growth. It analyzes transmission mechanisms, consumer spending, business investments, and long-run macroeconomic stability, providing policy implications for sustainable growth. -

The Role of Quantitative Easing in Stimulating Economic Activity

This research investigates the impact of quantitative easing programs on stimulating economic activity, examining liquidity effects, asset price inflation, credit creation, and potential long-term risks for financial stability. -

Central Bank Communication and Its Effect on Inflation Expectations

This study explores how central bank communication strategies influence inflation expectations. It focuses on the clarity, frequency, and credibility of policy announcements and their subsequent impact on market perceptions. -

Evaluating the Effectiveness of Inflation Targeting Policies

This dissertation assesses the effectiveness of inflation targeting policies in achieving price stability. It explores central bank credibility, policy flexibility, and the interplay with fiscal measures in modern economies. -

The Impact of Digital Currencies on Monetary Policy Effectiveness

This research examines how digital currencies—including central bank digital currencies (CBDCs)—influence traditional monetary policy tools, affecting payment systems, financial stability, and economic inclusiveness. -

Monetary Policy in Emerging Economies: Challenges and Strategies

This dissertation explores the unique challenges emerging economies face in implementing monetary policy. It examines issues such as capital flows, inflation volatility, exchange rate pressures, and policy credibility. -

Comparative Analysis of Monetary Policy Frameworks Across Economies

This study conducts a comparative analysis of monetary policy frameworks in advanced and developing economies. It focuses on institutional design, policy implementation, and resulting economic performance outcomes. -

Monetary Policy Response to Financial Crises

This dissertation investigates how monetary policy serves as a crisis management tool during financial downturns. It examines unconventional measures, emergency lending facilities, and coordination with fiscal policy. -

Exchange Rate Regimes and Monetary Policy Autonomy

This research explores the relationship between exchange rate regimes and the autonomy of monetary policy. It analyzes how fixed, floating, and managed rates influence policy effectiveness. -

The Role of Monetary Policy in Controlling Inflation

This dissertation examines the effectiveness of various monetary policy tools in controlling inflation, analyzing interest rates, reserve requirements, open market operations, and their impact on overall price stability. -

Monetary Policy and Income Inequality

This research examines how monetary policy decisions may influence income distribution. It explores the effects of interest rate adjustments and asset purchases on wealth disparities and societal equity. -

The Impact of Central Bank Independence on Policy Effectiveness

This dissertation investigates how central bank independence influences monetary policy effectiveness. It explores institutional frameworks, political pressures, and decision-making autonomy through comparative historical analysis. -

Assessing the Impact of Globalization on Monetary Policy Strategies

This research explores how globalization influences monetary policy decisions, analyzing cross-border capital flows, exchange rate dynamics, and coordination challenges faced by central banks in an interconnected global economy. -

The Effectiveness of Forward Guidance as a Monetary Policy Tool

This dissertation examines how central banks use forward guidance to shape market expectations. It evaluates its impact on investment decisions, inflation forecasts, and overall policy transmission. -

Monetary Policy and Financial Market Volatility

This study investigates the relationship between monetary policy actions and financial market volatility. It analyzes how interest rate changes, liquidity provisions, and policy uncertainty contribute to market fluctuations. -

The Impact of Monetary Policy on Exchange Rate Stability

This dissertation explores how various monetary policy tools influence exchange rate stability. It evaluates policy effectiveness in managing currency fluctuations in open, globally integrated economies. -

Monetary Policy and Consumer Confidence: An Empirical Analysis

This study explores how monetary policy actions—such as interest rate changes and liquidity injections—impact consumer confidence, spending behaviors, and overall economic sentiment, providing empirical evidence for policy adjustments. -

The Impact of Monetary Policy on Corporate Investment Decisions

This dissertation examines how changes in monetary policy influence corporate investment decisions. It assesses the effects of interest rates, liquidity conditions, and market expectations on capital allocation. -

Monetary Policy in a Low Interest Rate Environment

This research explores the challenges and opportunities of maintaining effective monetary policy in a persistently low interest rate environment, analyzing impacts on savings, lending, and long-term economic growth. -

The Influence of Global Economic Integration on National Monetary Policies

This dissertation examines how global economic integration influences national monetary policy decisions, exploring challenges related to capital mobility, exchange rate volatility, and cross-border financial regulation. -

Assessing the Role of Inflation Forecasting in Monetary Policy Decisions

This research explores methods for inflation forecasting and their integration into monetary policy decisions, examining model accuracy, forecasting challenges, and necessary policy adjustments based on predictions. -

The Effect of Fiscal-Monetary Policy Coordination on Economic Stability

This dissertation investigates how the coordination between fiscal and monetary policies affects overall economic stability, evaluating policy synergies, conflicting objectives, and the resulting impact on growth and inflation. -

Monetary Policy Transmission Mechanisms: A Case Study Approach

This research employs case studies to analyze the transmission mechanisms of monetary policy. It focuses on interest rate adjustments, credit channel effects, and the spillover impact on various economic sectors. -

Evaluating the Impact of Monetary Policy on Consumer Borrowing Behavior

This study examines how central bank policies affect consumer borrowing behavior. It focuses on interest rate changes, credit availability, and the broader implications for household debt levels. -

Monetary Policy and Its Impact on Capital Flows

This research examines the relationship between monetary policy decisions and international capital flows. It explores how policy adjustments affect cross-border investments and global financial market stability. -

Evaluating the Role of Monetary Aggregates in Policy Formulation

This dissertation investigates how central banks use monetary aggregates like M1 and M2 in formulating policy. It analyzes their relevance for predicting inflation and economic activity. -

Monetary Policy and the Role of Reserve Requirements

This study examines how adjustments in reserve requirements affect banking sector liquidity, credit availability, and overall monetary policy transmission, and offers insights to refine stability. -

Monetary Policy Implementation in the Face of Global Shocks

This research examines how central banks adjust their monetary policy strategies during global economic shocks, analyzing adaptive measures, policy innovations, and their effectiveness in crisis mitigation. -

Exploring the Impact of Unconventional Monetary Policies on Banking

This dissertation investigates how unconventional monetary policies—such as negative interest rates and asset purchase programs—influence banking operations, lending behaviors, and financial stability in contemporary settings. -

Assessing the Role of Inflation Forecasting in Policy Decisions

This research explores methods for forecasting inflation and their integration into monetary policy. It examines model accuracy, challenges, and subsequent policy adjustments based on predictive insights. -

Monetary Policy and Its Impact on Unemployment Rates

This dissertation analyzes how monetary policy interventions influence unemployment rates by investigating the interplay between interest rate policies, job creation, and labor market dynamics to derive meaningful policy implications. -

Monetary Policy and Interbank Lending: Effects on Liquidity

This study examines how monetary policy decisions influence interbank lending rates, assessing the transmission of policy signals and the resulting effects on overall banking system liquidity. -

Monetary Policy and Financial Innovation: An Evolving Relationship

This dissertation investigates how financial innovations—including fintech advancements and digital banking—reshape monetary policy effectiveness and central banking practices, offering insights for future regulatory frameworks. -

Evaluating the Impact of Monetary Policy on Foreign Direct Investment

This research explores how monetary policy decisions influence foreign direct investment flows. It examines the role of interest rates, exchange rate volatility, and investor confidence in shaping global capital movements. -

The Role of Central Bank Balance Sheets in Policy Effectiveness

This study examines how changes in central bank balance sheets—through asset purchases and sales—influence monetary policy effectiveness and overall financial market conditions, and offers insights to refine stability. -

Monetary Policy and Its Impact on Inflation Persistence

This dissertation explores the factors contributing to inflation persistence despite monetary policy efforts. It analyzes structural economic conditions, market expectations, and policy lags, and offers insights for more effective policy design. -

The Impact of Monetary Policy on Banking Profitability

This research examines how central bank policy decisions affect bank profitability by analyzing interest margins, loan growth, risk-taking behaviors, and overall financial performance, and provides policy recommendations for enhancing sector efficiency. -

Monetary Policy and Its Influence on Stock Market Performance

This study investigates how changes in monetary policy, including interest rate adjustments and liquidity injections, affect stock market performance and investor behavior, providing empirical evidence through market data analysis. -

Monetary Policy and the Dynamics of Price Stability

This research investigates how different monetary policy tools interact to maintain price stability. It examines trade-offs between controlling inflation and supporting economic growth, and provides insights for optimizing policy frameworks. -

The Role of Monetary Policy in Shaping Labor Market Outcomes

This dissertation examines how monetary policy influences labor market conditions, analyzing the effects of interest rate changes on employment, wage levels, and overall job market dynamics. -

Monetary Policy and the Stability of Emerging Market Economies

This research explores how emerging market economies use monetary policy to stabilize their economies. It addresses challenges related to inflation, capital outflows, and currency volatility with emphasis on policy adaptations. -

Monetary Policy and Its Impact on Central Bank Legitimacy

This study explores how monetary policy decisions contribute to the legitimacy of central banks. It analyzes transparency, accountability, and policy communication while offering insights for enhancing institutional trust. -

Monetary Policy and Exchange Rate Volatility: A Comparative Study

This dissertation conducts a comparative study on how different monetary policy regimes influence exchange rate volatility. It assesses the effectiveness of various policy tools across countries to offer actionable insights. -

Evaluating the Impact of Monetary Policy on National Savings Rates

This research examines how monetary policy decisions affect national savings rates. It analyzes the interplay between interest rate policies, consumer confidence, and economic incentives through cross-country analysis. -

Monetary Policy and Its Impact on Business Investment Decisions

This dissertation investigates how monetary policy influences business investment decisions by analyzing the relationship between interest rates, credit conditions, and corporate decision-making, and its broader implications for economic productivity. -

The Effect of Monetary Policy on Interest Rate Spreads

This study examines how central bank policies affect interest rate spreads between different loan types, exploring implications for credit markets and the overall health of the financial sector. -

Monetary Policy and Its Influence on Bank Lending Standards

This research investigates how changes in monetary policy affect bank lending standards, analyzing impacts on credit quality, risk assessment, and loan approval processes, and suggesting improvements in lending practices. -

The Role of Monetary Policy in Mitigating Financial Bubbles

This dissertation investigates how monetary policy can be used to mitigate the formation of financial bubbles. It analyzes the interplay between policy measures, investor behavior, and market sentiment. -

Evaluating the Impact of Monetary Policy on Consumption Patterns

This research examines how monetary policy affects consumption patterns by analyzing the influence of interest rate changes, credit conditions, and consumer confidence on spending behaviors, and providing insights for macroeconomic stability. -

Monetary Policy and the Evolution of Payment Systems

This study explores how monetary policy influences the evolution of payment systems. It examines the integration of digital technologies, regulatory changes, and their impact on transaction efficiency. -

The Role of Monetary Policy in Promoting Economic Resilience

This dissertation examines how well-designed monetary policy can promote economic resilience. It analyzes responses to shocks, policy flexibility, and central bank innovation to build stronger policy frameworks. -

Evaluating the Impact of Interest Rate Policy on Inflation Control

This research investigates the effectiveness of interest rate policies in controlling inflation by analyzing empirical data, policy shifts, and lagged economic responses, to provide actionable insights for policymakers. -

Monetary Policy and the Transmission of Economic Shocks

This dissertation investigates how monetary policy transmits economic shocks throughout the economy. It analyzes the channels through which policy actions affect various sectors and overall stability. -

Evaluating the Impact of Central Bank Announcements on Market Volatility

This study examines how central bank announcements and policy statements influence market volatility, exploring the relationship between communication strategies and investor reactions, and providing a framework for improved communication. -

Monetary Policy and Sustainable Development Goals

This research explores how monetary policy can support sustainable development goals. It analyzes the interplay between environmental considerations, economic growth, and policy instruments to provide a roadmap for green economic policies. -

The Impact of Monetary Policy on the Informal Economy

This dissertation examines how monetary policy decisions influence the informal economy. It analyzes spillover effects on unregulated sectors, employment, and overall economic performance, and offers insights for inclusive policy design. -

Monetary Policy and Its Effect on Long-Term Interest Rate Trends

This study investigates how central bank policies affect long-term interest rate trends after adjusting for inflation, analyzing implications for borrowing costs, savings, and overall economic growth. -

Evaluating the Role of International Monetary Policy Coordination

This research investigates how international coordination of monetary policies among major economies affects global financial stability, exchange rates, and cross-border capital flows, and offers recommendations for enhancing global policy synergy. -

Monetary Policy and Economic Divergence Among Countries

This dissertation examines how divergent monetary policy approaches contribute to economic divergence among countries. It analyzes policy effectiveness, external vulnerabilities, and long-term development trajectories, providing recommendations for convergence. -

Evaluating the Impact of Monetary Policy on Business Cycle Synchronization

This research investigates how monetary policy decisions influence the synchronization of business cycles across regions, examining spillover effects and coordinated economic responses to promote stability. -

Monetary Policy and Its Impact on Consumer Credit Markets

This dissertation investigates how monetary policy influences consumer credit availability by examining the interplay between interest rate policies, bank lending practices, and household borrowing, with implications for stability. -

The Role of Monetary Policy in Shaping Central Bank Credibility

This research explores how monetary policy decisions affect central bank credibility. It analyzes transparency, accountability, and the communication of policy objectives to enhance institutional legitimacy. -

Monetary Policy and Its Impact on Foreign Exchange Reserves

This dissertation examines how monetary policy decisions affect the accumulation and management of foreign exchange reserves, analyzing implications for national economic stability and external balance. -

Evaluating the Impact of Monetary Policy on Wealth Distribution

This study examines how monetary policy influences wealth distribution by analyzing the effects of interest rate changes, asset price fluctuations, and credit conditions on income inequality. -

Monetary Policy and Its Impact on Export Competitiveness

This research investigates how monetary policy measures—especially interest rate and exchange rate policies—affect the export competitiveness of an economy in the global market. -

The Role of Monetary Policy in Achieving Fiscal Sustainability

This dissertation examines how monetary policy can contribute to fiscal sustainability. It analyzes interactions between central bank actions, government debt management, and public finance stability. -

Monetary Policy and the Transmission of Credit Market Liquidity

This study investigates how central bank policies affect liquidity in credit markets, exploring interest rate adjustments, regulatory measures, and market sentiment, and offering recommendations for improved liquidity. -

Monetary Policy and Its Impact on Interbank Lending Rates

This dissertation examines how central bank policy decisions influence interbank lending rates, assessing the transmission of policy signals and the effects on overall banking system liquidity. -

Monetary Policy and Its Influence on Cross-Border Capital Flows

This research investigates how monetary policy affects cross-border capital flows by analyzing the impact of policy decisions on investor behavior, risk perceptions, and global financial integration. -

Evaluating the Impact of Monetary Policy on Sovereign Credit Ratings

This study investigates how monetary policy measures affect sovereign credit ratings, analyzing the interplay between central bank actions, fiscal discipline, and external economic conditions, providing insights to improve ratings. -

Monetary Policy and Its Impact on Foreign Direct Investment

This dissertation explores how monetary policy decisions influence foreign direct investment flows by examining the roles of interest rates, exchange rate volatility, and investor confidence in global capital movements. -

The Role of Monetary Policy in Shaping Future Economic Trends

This research explores the long-term effects of current monetary policy measures on shaping future economic trends by analyzing historical data, predictive models, and evolving policy paradigms. -

Evaluating the Impact of Monetary Policy on National Debt Sustainability

This dissertation examines how monetary policy actions influence public debt sustainability, analyzing the interplay between interest rates, fiscal policy, and government borrowing in maintaining manageable debt levels. -

Monetary Policy and Its Impact on Business Investment Decisions

This study investigates how monetary policy influences business investment by analyzing the relationship between interest rates, credit conditions, and corporate decision-making, and its implications for productivity. -

Evaluating the Impact of Central Bank Lending Facilities on Financial Stability

This research investigates how central bank lending facilities, such as discount windows, support financial stability during market stress and liquidity shortages, and offers insights to improve crisis management. -

Monetary Policy and Its Role in Mitigating Financial Bubbles

This dissertation investigates how monetary policy can be employed to mitigate financial bubbles by analyzing the interplay between policy measures, investor behavior, and market sentiment. -

Evaluating the Impact of Monetary Policy on Consumption Patterns

This study examines how monetary policy affects consumption patterns by analyzing the influence of interest rate changes, credit conditions, and consumer confidence on spending behaviors. -

Monetary Policy and the Evolution of Payment Systems

This research explores how monetary policy influences the evolution of payment systems, focusing on digital technologies, regulatory changes, and improvements in transaction efficiency. -

The Role of Monetary Policy in Promoting Economic Resilience

This dissertation examines how effective monetary policy promotes economic resilience by analyzing responses to shocks and policy flexibility to build stronger policy frameworks. -

Evaluating the Impact of Monetary Policy on Stock Market Performance

This study investigates how changes in monetary policy—including interest rate adjustments and liquidity injections—affect stock market performance and investor behavior, providing empirical evidence for policy impacts. -

Monetary Policy and Its Impact on Credit Risk

This research examines how monetary policy decisions affect credit risk in the financial system by investigating interest rate impacts, liquidity provisions, and risk assessment frameworks, and offers strategies to mitigate vulnerabilities. -

Evaluating the Impact of Monetary Policy on Banking Profitability

This dissertation examines how central bank policies affect bank profitability by analyzing interest margins, loan growth, risk-taking behaviors, and overall financial performance, with recommendations for sector efficiency. -

Monetary Policy and Its Influence on Consumer Savings Behavior

This study investigates how changes in monetary policy, particularly interest rate adjustments, affect household savings behavior, analyzing implications for long-term financial stability and economic growth. -

Evaluating the Role of Monetary Policy in Mitigating Exchange Rate Crises

This research investigates how effective monetary policy measures can mitigate exchange rate crises, analyzing policy tools, market responses, and offering framework for crisis management. -

Monetary Policy and Its Impact on Real Interest Rates

This dissertation examines how central bank policies affect real interest rates after adjusting for inflation, analyzing implications for borrowing costs, savings, and overall economic growth. -

Evaluating the Role of International Monetary Policy Coordination

This research investigates how international coordination of monetary policies among major economies affects global financial stability, exchange rates, and cross-border capital flows, offering recommendations for enhanced synergy. -

Monetary Policy and Its Impact on Economic Divergence

This dissertation examines how divergent monetary policy approaches contribute to economic divergence among countries, analyzing policy effectiveness, external vulnerabilities, and long-term development trajectories, with recommendations for convergence. -

Evaluating the Impact of Monetary Policy on Business Cycle Synchronization

This research investigates how monetary policy decisions influence the synchronization of business cycles across regions, examining spillover effects and coordinated economic responses to promote stability. -

Monetary Policy and Its Impact on Consumer Credit Markets

This dissertation examines how monetary policy influences consumer credit availability by analyzing the interplay between interest rate policies, bank lending practices, and household borrowing, with implications for financial stability. -

The Role of Monetary Policy in Shaping Central Bank Credibility

This study explores how monetary policy decisions affect central bank credibility by analyzing transparency, accountability, and policy communication, and provides insights for enhancing institutional trust. -

Monetary Policy and Its Impact on Foreign Exchange Reserves

This dissertation examines how monetary policy decisions affect the accumulation and management of foreign exchange reserves, analyzing implications for national economic stability and external balance. -

Evaluating the Impact of Monetary Policy on Wealth Distribution

This study examines how monetary policy influences wealth distribution by analyzing the effects of interest rate changes, asset price fluctuations, and credit conditions on income inequality. -

Evaluating the Impact of Monetary Policy on Export-Import Balances

This research investigates how monetary policy decisions affect a country’s export-import balances by analyzing the interplay between interest rates, exchange rates, and international trade dynamics to inform strategies for trade performance. -

Monetary Policy and Its Impact on Sovereign Credit Ratings

This dissertation investigates how monetary policy measures affect sovereign credit ratings, analyzing the interplay between central bank actions, fiscal discipline, and external economic conditions, providing insights to improve ratings. -

Monetary Policy and Its Impact on Foreign Direct Investment

This study explores how monetary policy decisions influence foreign direct investment flows by examining the roles of interest rates, exchange rate volatility, and investor confidence in shaping global capital movements. -

The Role of Monetary Policy in Shaping Future Economic Trends

This dissertation explores the long-term effects of current monetary policy measures on shaping future economic trends by analyzing historical data, predictive models, and evolving policy paradigms. -

Evaluating the Impact of Monetary Policy on National Debt Sustainability

This research examines how monetary policy actions influence public debt sustainability by analyzing the interplay between interest rates, fiscal policy, and government borrowing in maintaining manageable debt levels. -

Monetary Policy and Its Impact on Business Investment Decisions

This study investigates how monetary policy influences business investment by analyzing the relationship between interest rates, credit conditions, and corporate decision-making, with implications for productivity. -

Evaluating the Impact of Monetary Policy on Stock Market Performance

This research examines how changes in monetary policy, including interest rate adjustments and liquidity injections, affect stock market performance and investor behavior, providing empirical evidence through market data analysis. -

Monetary Policy and Its Role in Shaping Future Economic Trends

This dissertation explores the long-term effects of current monetary policy measures on future economic trends by analyzing historical data, predictive models, and evolving policy paradigms to inform policymakers.

Feel free to tailor these topics further to match your specific research interests and academic requirements.